Variable interest rate - basic owner-occupied home loans

For basic owner-occupied home loans with principal and interest repayments.

| LVRⓘ | Basic Interest rate | Basic Comparison rate‡ | Offset Interest rate | Offset Comparison rate‡ |

|---|---|---|---|---|

| ≤ 60% | 5.64% pa | 5.66% pa | 5.64% pa | 5.89% pa |

| ≤ 70% | 5.64% pa | 5.66% pa | 5.64% pa | 5.89% pa |

| ≤ 80% | 5.69% pa | 5.71% pa | 5.69% pa | 5.94% pa |

| ≤ 90% | 5.89% pa | 5.91% pa | 5.89% pa | 6.14% pa |

| ≤ 95% | 6.69% pa | 6.72% pa | 6.69% pa | 6.93% pa |

A variable interest rate on your home loan allows you flexibility to use your savings to reduce the interest you pay by using offset accounts. With up to 10 offset accounts per loan account†, you can structure your offset accounts in a way that makes your savings work for you.

With a variable interest rate on your home loan, there’s no limit on additional payments. Whether you’re using an offset or redraw facility, extra repayments could help you pay off your home loan faster and reduce the amount of interest you pay over the life of your loan.

Sometimes it’s good to have a little buffer in your back pocket. Enjoy peace of mind knowing that you have unlimited, fee-free access to any additional repayments you’ve made on your variable home loan with our redraw facility.

Settle for nothing less than great rates and low fees.

Save over the life of your home loan with access to great rates and no hidden fees or charges.

Turnaround times that won’t leave you wondering.

At Macquarie, we pride ourselves on having market-leading turnaround times so you can make your next move with confidence.

When it comes to your home loan, we’re flexible.

With fixed rates for more certainty, variable rates, and offset accounts to reduce the amount of interest you pay - you’ve got options.

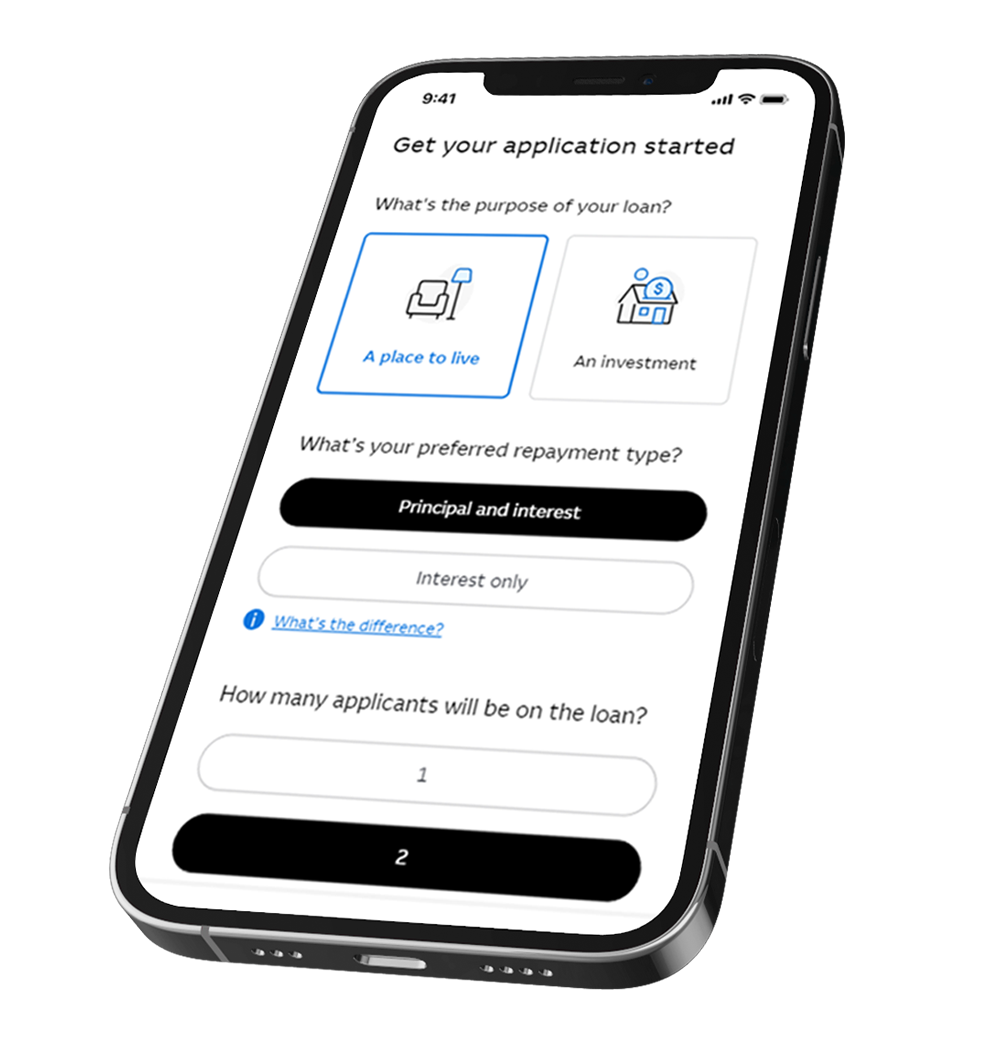

An award-winning digital app.~

Plan your future, keep track of your investment, and stay in control. Managing your home loan has never been easier from the palm of your hand.

To help you complete your home loan application, make sure you have the following information on hand:

You can start your application now, save your progress, and come back to it later if you need more time or additional information

LVR is the amount you need to borrow, calculated as a percentage of the value of your property. For example, if your loan amount is $400K and your property value is $500K, then your LVR is 80%.

Yes, generally you can make extra repayments on your variable interest rate home loan, without paying any additional fees.

You can do this via our Macquarie Online Banking or Mobile Banking app. Our Macquarie Help Centre has more information on how to make extra repayments on your home loan.

Please note, if you have a Home Loan account with a BSB starting with 183,

Yes, typically if you have an Offset Home Loan variable interest rate account, you’ll be able to open and link up to 10 offset accounts.

For company or trust borrowers and home loans with a BSB starting with 183, additional offset accounts can’t be opened after you’ve settled your home loan.

Visit Macquarie Help Centre on how to open additional offset accounts on Macquarie Online Banking, including opening joint offset accounts.

Fixed rate home loans have an interest rate that is fixed for a set period of time (typically from one to five years). At the end of the fixed rate term, the loan will usually switch to a variable rate.

Variable rate home loans have an interest rate that can move up or down according to market forces, which impacts the amount of interest you pay and may change your contracted monthly repayments.

Macquarie home loans are flexible and allow you to access both a fixed rate and variable rate for your loan. As a borrower, this means you can:

Splitting your loan between variable and fixed interest rates gives you flexibility to structure your loan to suit your circumstances. You can divide your home loan in a variety of ways, such as locking in a fixed interest rate portion and variable interest rate portion, to take advantage of a mix of rate types over the life of your loan.

Please note: You can’t have the entirety of your offset home loan assigned to a fixed rate. You must have at least $20k of your offset home loan assigned to a variable interest rate.

Our team of home loan experts are here to help. Request a call by completing the form and we'll typically make contact with you within 1 business day.

For more information, view the full Macquarie home loans terms and conditions and the Macquarie electronic banking terms and conditions.

This information is provided by Macquarie Bank Limited ABN 46 008 583 542 AFSL and Australian Credit Licence 237502 and does not take into account your objectives, financial situation or needs. You should consider whether it is appropriate for you. Lending criteria, fees and T&Cs apply.

Variable interest rate and comparison rate for basic owner-occupied home loans with principal and interest repayment. Rate applies for new loans when you borrow up to 60% of the property value with a principal and interest repayment variable rate loan. Subject to change without notice.

The comparison rates are based on a loan for $150,000 and a term of 25 years. WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

The information in this calculator is by way of example only and is not a prediction or professional financial advice. Calculations are not forecasts, but may assist you in making your own projections. Subject to law, Macquarie will not be liable for any loss or damage caused by your use of the calculator. The information in the calculator does not constitute an offer to lend or imply the product is suitable for you.

Rate applies to new loans with a fixed rate loan. Subject to change without notice. Fixed rate loans may be subject to significant break costs. Please refer to the loan contracts for terms and conditions regarding break costs. At the end of the fixed rate period, the interest rate will revert to the discount variable rate applicable at that time.

Open up to 10 offset accounts per variable loan account if you have an individual or joint borrower home loan. Company and trust borrowers can open up to 4 offset accounts which must be opened at application. Offset accounts cannot be linked to fixed rate loan accounts. For loans, with both a fixed and variable rate loan account, the variable rate loan account must have a minimum limit of $20,000 to enable an offset account to be linked. Only applicable for Offset Home Loans.

The Offset Home Loan Facility fee is payable in exchange for the ability to open and link offset accounts. The fee is payable in two equal instalments every 6 months per facility. The first fee is payable 6 months after your settlement date, then the Offset Home Loan Facility fee is payable every 6 months thereafter (unless you switch your loan to a Basic Home Loan).

Rate applies for new home loans with principal and interest repayment fixed rate when you borrow up to 70% of the property value. Subject to change without notice.

Our digital banking platforms are part of why we were awarded Money Magazine’s Bank of the Year 2023/2024.

Due to state and territory laws, restrictions may apply to digitally signing the Mortgage Form.

Home loan information and interest rates are current as at 23 May 2025 for new loans only and are subject to change.