Variable interest rate - basic owner-occupied home loans

For basic owner-occupied home loans with principal and interest repayments.

| LVR# | Basic Interest rate | Basic Comparison rate‡ | Offset Interest rate | Offset Comparison rate‡ |

|---|---|---|---|---|

| ≤ 60% | 5.64% pa | 5.66% pa | 5.64% pa | 5.89% pa |

| ≤ 70% | 5.64% pa | 5.66% pa | 5.64% pa | 5.89% pa |

| ≤ 80% | 5.69% pa | 5.71% pa | 5.69% pa | 5.94% pa |

| ≤ 90% | 5.89% pa | 5.91% pa | 5.89% pa | 6.14% pa |

| ≤ 95% | 6.69% pa | 6.72% pa | 6.69% pa | 6.93% pa |

| LVR# | Basic Interest rate | Basic Comparison rate‡ | Offset Interest rate | Offset Comparison rate‡ |

|---|---|---|---|---|

| 1 year fixed rate° | ||||

| ≤ 70% | 5.29% pa | 5.63% pa | 5.29% pa | 5.86% pa |

| ≤ 80% | 5.39% pa | 5.68% pa | 5.39% pa | 5.91% pa |

| ≤ 95% | 5.65% pa | 6.61% pa | 5.65% pa | 6.83% pa |

| 2 year fixed rate° | ||||

| ≤ 70% | 5.19% pa | 5.58% pa | 5.19% pa | 5.81% pa |

| ≤ 80% | 5.29% pa | 5.64% pa | 5.29% pa | 5.87% pa |

| ≤ 95% | 5.79% pa | 6.54% pa | 5.79% pa | 6.76% pa |

| 3 year fixed rate° | ||||

| ≤ 70% | 5.19% pa | 5.54% pa | 5.19% pa | 5.77% pa |

| ≤ 80% | 5.29% pa | 5.60% pa | 5.29% pa | 5.83% pa |

| ≤ 95% | 5.79% pa | 6.46% pa | 5.79% pa | 6.68% pa |

| 4 year fixed rate° | ||||

| ≤ 70% | 5.39% pa | 5.58% pa | 5.39% pa | 5.81% pa |

| ≤ 80% | 5.49% pa | 5.64% pa | 5.49% pa | 5.87% pa |

| ≤ 95% | 5.99% pa | 6.46% pa | 5.99% pa | 6.68% pa |

| 5 year fixed rate° | ||||

| ≤ 70% | 5.39% pa | 5.56% pa | 5.39% pa | 5.79% pa |

| ≤ 80% | 5.49% pa | 5.63% pa | 5.49% pa | 5.86% pa |

| ≤ 95% | 5.99% pa | 6.41% pa | 5.99% pa | 6.63% pa |

Note: Offset benefits are not available while the linked Loan Account is on a fixed rate of interest

| LVR# | Basic Interest rate | Basic Comparison rate‡ | Offset Interest rate | Offset Comparison rate‡ |

|---|---|---|---|---|

| 1 year fixed rate° | ||||

| ≤ 70% | 5.45% pa | 5.74% pa | 5.45% pa | 5.96% pa |

| ≤ 80% | 5.55% pa | 5.84% pa | 5.55% pa | 6.06% pa |

| ≤ 90% | 5.95% pa | 6.65% pa | 5.95% pa | 6.87% pa |

| 2 year fixed rate° | ||||

| ≤ 70% | 5.35% pa | 5.69% pa | 5.35% pa | 5.92% pa |

| ≤ 80% | 5.45% pa | 5.79% pa | 5.45% pa | 6.02% pa |

| ≤ 90% | 5.79% pa | 6.54% pa | 5.79% pa | 6.76% pa |

| 3 year fixed rate° | ||||

| ≤ 70% | 5.35% pa | 5.66% pa | 5.35% pa | 5.89% pa |

| ≤ 80% | 5.45% pa | 5.76% pa | 5.45% pa | 5.98% pa |

| ≤ 90% | 5.79% pa | 6.46% pa | 5.79% pa | 6.69% pa |

| 4 year fixed rate° | ||||

| ≤ 70% | 5.55% pa | 5.70% pa | 5.55% pa | 5.93% pa |

| ≤ 80% | 5.65% pa | 5.80% pa | 5.65% pa | 6.02% pa |

| ≤ 90% | 5.89% pa | 6.43% pa | 5.89% pa | 6.65% pa |

| 5 year fixed rate° | ||||

| ≤ 70% | 5.55% pa | 5.68% pa | 5.55% pa | 5.91% pa |

| ≤ 80% | 5.65% pa | 5.78% pa | 5.65% pa | 6.01% pa |

| ≤ 90% | 5.89% pa | 6.37% pa | 5.89% pa | 6.59% pa |

Note: Offset benefits are not available while the linked Loan Account is on a fixed rate of interest

Get to know your rate options and easily calculate your rates and repayments.

Discover the home loan that best suits your needs by comparing our products and features.

Settle for nothing less than great rates and low fees.

Save over the life of your home loan with access to great rates and no hidden fees or charges.

Turnaround times that won’t leave you wondering.

At Macquarie, we pride ourselves on having market-leading turnaround times so you can make your next move with confidence.

When it comes to your home loan, we’re flexible.

With fixed rates for more certainty, variable rates, and offset accounts to reduce the amount of interest you pay - you’ve got options.

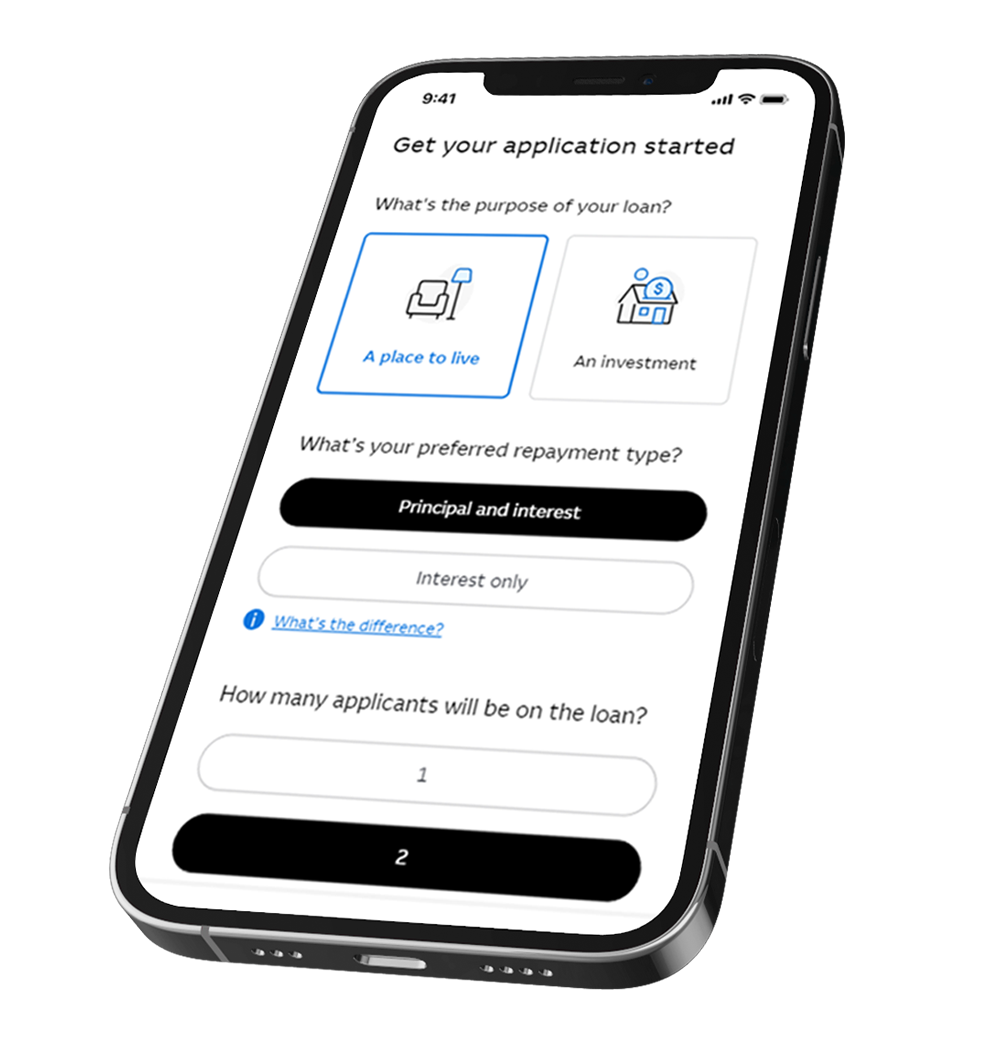

An award-winning digital app.~

Plan your future, keep track of your investment, and stay in control. Managing your home loan has never been easier from the palm of your hand.

LVR is the amount you need to borrow, calculated as a percentage of the value of your property. For example, if your loan amount is $400K and your property value is $500K, then your LVR is 80%.

Having multiple offset accounts can help you to bucket your savings. This can help you manage your budget if you're saving for a few big things (like another property, a holiday, a wedding or a new car).

Having multiple offset accounts linked to your home loan ensures that all of your savings are working towards reducing the interest paid on your home loan.

It is important to note that if your offset account balance exceeds your home loan account balance, you won’t be paid interest on the excess amount. This excess amount also is not offsetting any interest payable on your home loan account.

To help you complete your home loan application, make sure you have the following information on hand:

You can start your application now, save your progress, and come back to it later if you need more time or additional information

Once you’ve completed an application with your broker or home loan specialist, we can (in most cases) provide you with a pre-approval within one business day if your application qualifies. Once you’re successful with a property and provide us with all required documentation, we work quickly to provide you with unconditional approval and open your home loan account.

This timing depends on how quickly we can verify your identity, assess your application, and transfer security.

We’ll let you know by email if your application is successful and then work with your solicitor or representative to arrange the settlement. Once completed we’ll let you know when your account is open and ready to use.

If you have any questions about the status of your application, talk to your broker or your home loan specialist.

Fixed rate home loans have an interest rate that is fixed for a set period of time (typically from one to five years). At the end of the fixed rate term, the loan will usually switch to a variable rate.

Variable rate home loans have an interest rate that can move up or down according to market forces, which impacts the amount of interest you pay and may change your contracted monthly repayments.

Macquarie home loans are flexible and allow you to access both a fixed rate and variable rate for your loan. As a borrower, this means you can:

Splitting your loan between variable and fixed interest rates gives you flexibility to structure your loan to suit your circumstances. You can divide your home loan in a variety of ways, such as locking in a fixed interest rate portion and variable interest rate portion, to take advantage of a mix of rate types over the life of your loan.

Please note: You can’t have the entirety of your offset home loan assigned to a fixed rate. You must have at least $20k of your offset home loan assigned to a variable interest rate.

Our team of home loan experts are here to help. Request a call by completing the form and we'll typically make contact with you within 1 business day.

The information in this calculator is by way of example only and is not a prediction or professional financial advice. Calculations are not forecasts, but may assist you in making your own projections. Subject to law, Macquarie will not be liable for any loss or damage caused by your use of the calculator. The information in the calculator does not constitute an offer to lend or imply the product is suitable for you.

Rate applies for new loans when you borrow up to 60% of the property value with a principal and interest repayment variable rate loan. Subject to change without notice.

The comparison rates are based on a loan for $150,000 and a term of 25 years. WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

Open up to 10 offset accounts per variable loan account if you have an individual or joint borrower home loan. Company and trust borrowers can open up to 4 offset accounts which must be opened at application. Offset accounts cannot be linked to fixed rate loan accounts. For loans, with both a fixed and variable rate loan account, the variable rate loan account must have a minimum limit of $20,000 to enable an offset account to be linked. Only applicable for Offset Home Loans.

The Offset Home Loan Facility fee is payable in exchange for the ability to open and link offset accounts. The fee is payable in two equal instalments every 6 months per facility. The first fee is payable 6 months after your settlement date, then the Offset Home Loan Facility fee is payable every 6 months thereafter (unless you switch your loan to a Basic Home Loan).

Fixed rate loan accounts may be subject to significant break costs. Please refer to the loan contracts for terms and conditions regarding break costs. At the end of the fixed rate period, the interest rate will revert to the discount variable rate applicable at that time.

Approval is subject to Macquarie credit criteria and suitability assessment. Terms and conditions apply and are available upon request. Fees and charges apply. Allow up to 10 working days to process your application. Rewards are earned on eligible purchases only.

We don’t charge fees for card purchases or transactions made or processed outside Australia but others, such as the banks of international merchants, might.

The calculations are based on a principal and interest repayment type only. Principal and interest repayments are calculated based on the loan term, interest rate and loan limit.

If you have a Macquarie Offset Home Loan, this fee is waived (for the Macquarie Black Card and Macquarie Platinum Card) for the period you hold this product with us. Learn about current annual fees if you discharge your home loan or cease to hold a Macquarie Offset Home Loan. Other fees and charges may apply.

Our digital banking platforms are part of why we were awarded Money Magazine’s Bank of the Year 2023/2024.

This information is provided by Macquarie Bank Limited ABN 46 008 583 542 AFSL and Australian Credit Licence 237502 and does not take into account your objectives, financial situation or needs. You should consider whether it is appropriate for you. Lending criteria, fees and T&Cs apply.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Home loan information and interest rates are current as at 23 May 2025 for new loans only and are subject to change.