The Financial Services Royal Commission made several recommendations in relation to how advisers and platforms monitor and charge fees for financial advice.

The Federal Government legislative requirements effective 1 July 2021 include:

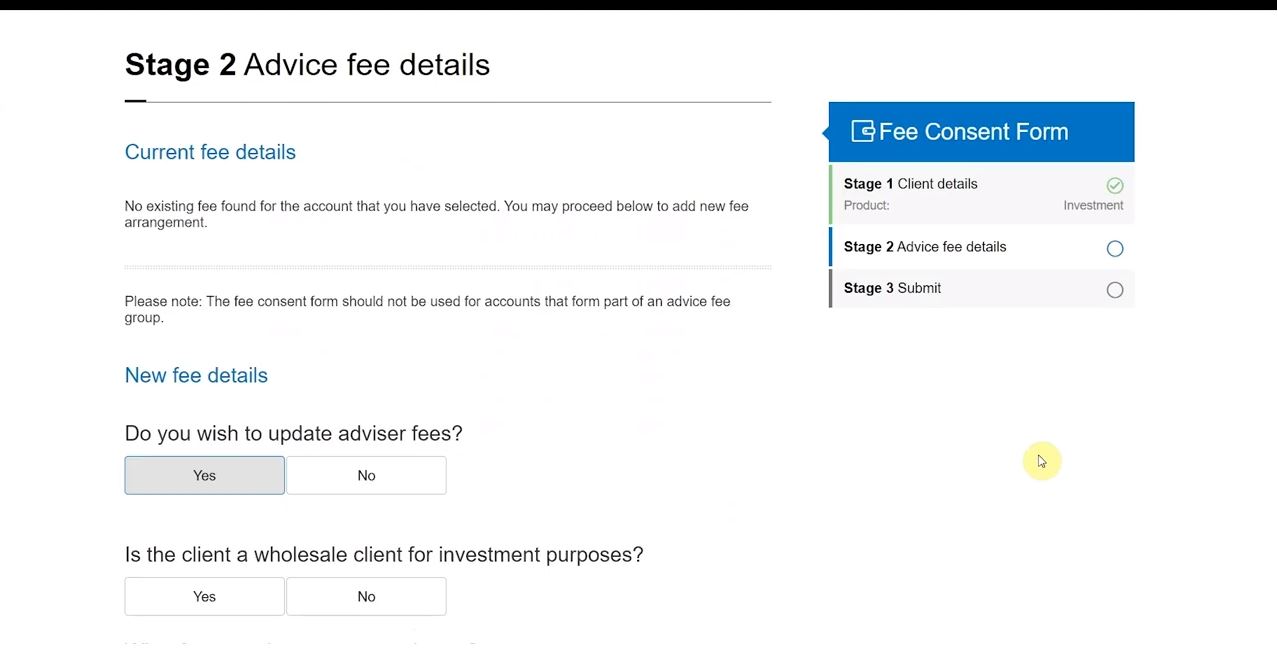

- ongoing fee arrangements are renewed annually

- advisers disclose in writing the total fees that will be charged, including a dollar estimate of the fees to be charged during the following 12-month period

- advisers set out the services that will be provided during the following 12-month period when the advice fees are deducted from a superannuation or pension account

- written consent is obtained from a client before fees can be deducted from a client’s account.

Further, fees can’t be deducted from superannuation accounts unless:

- the fee is in accordance with an arrangement that the member has entered into

- the member has consented in writing to being charged the fee, and

- the Trustee has the written consent or a copy of the consent.

Fee Disclosure Statements (FDS) will also show information for fees and services provided for the previous and coming year rather than the previous year only.

Watch now

Loading video...

To find out more about the new legislation, please visit the ASIC website.