Open a Macquarie Transaction Account in 3 minutes.

Then, simply transfer money into your account and add your debit card to your mobile wallet to pay on the go, instantly.

Set your savings in motion

Conditions are catching out Australians on their savings accounts. Learn how you can join the Australians who are getting the most out of every dollar, every day.

Digital features

- Mobile banking

- Added security

- Travel benefits

Manage your money with Macquarie Mobile Banking

Manage your money with Macquarie Mobile Banking

The Macquarie Mobile Banking app is designed to make your life easier.

Switch on push notifications to stay across all your account activity.

Attach receipts and tag statements to make tax time easier.

Supercharge your security with Macquarie Authenticator

Supercharge your security with Macquarie Authenticator

The Macquarie Authenticator app connects seamlessly with your Macquarie digital banking to supercharge your account security.

- Authorise transactions and account changes before they happen.

- It works even without data – keeping you safe 24/7, no matter the location.

Macquarie Authenticator

Loading video...

Travel light with the Macquarie debit card

Travel light with the Macquarie debit card

Travelling overseas? Keep your banking all in one place. The Macquarie debit card works right around the world.

- Enjoy $0 international account fees on overseas purchases, both in-store and online.^

- Notify us of your trip directly in the app and access extra travel features such as the current exchange rate.

greece-sunset

greece-sunset

Award-winning banking

Enjoy great value and award-winning banking every day with our transaction and savings account, cash management account, and term deposit.

More benefits

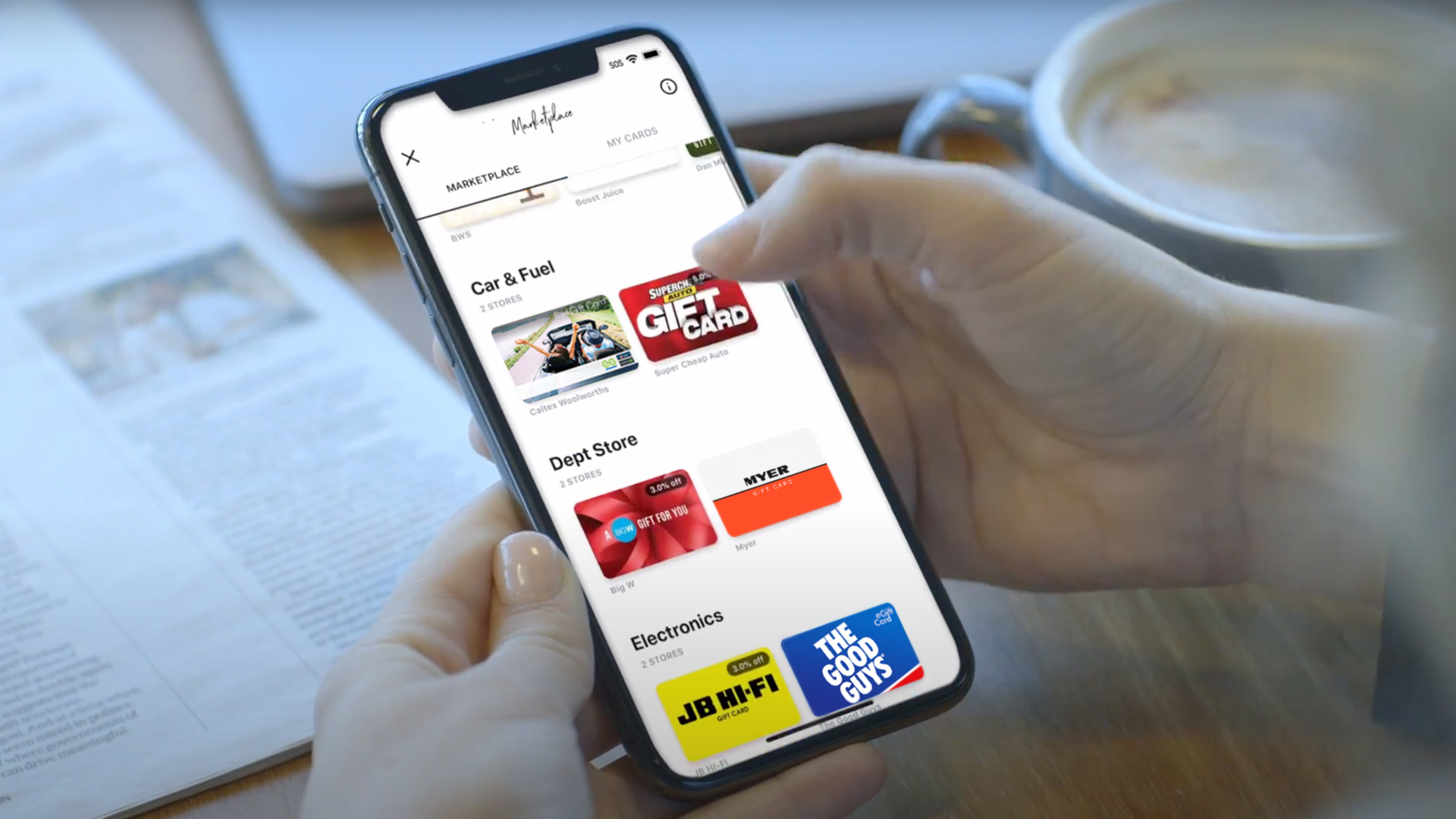

Macquarie Marketplace

Make your money go further with up to 10% off on eGift cards to use at over 50 different retailers across Australia.

PayID

Send and receive payments in real time - 24 hours a day, 7 days a week. Simply link one of your eligible accounts to your mobile number.

Credit cards

Credit cards are available as part of a Macquarie offset home loan package.

"I want my savings to take me to a place where I can be financially free."

Looking for a Business savings account?

A high-interest online savings account with no fees - because everything counts in business.

Existing customers

Additional information

This information has been prepared by Macquarie Bank Limited AFSL and Australian Credit Licence 237502 (MBL) and does not take into account your objectives, financial situation or needs. You should consider whether it is appropriate for you. Lending criteria, fees and T&Cs apply.

PayID is a registered trademark of NPP Australia Limited.

We don’t charge any fees in connection with our transaction and savings account products but others, such as other financial institutions, may.

We don’t charge fees for card purchases or transactions made or processed outside Australia but others, such as the banks of international merchants, might.

Government Guarantee: The Australian Government guarantees aggregated deposits with Australian authorised deposit-taking institutions, including Macquarie Bank, of up to $A250,000. Further information about the Government Guarantee can be obtained from the APRA website at www.fcs.gov.au

Apple, the Apple logo & iPhone are trademarks of Apple Inc, registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Pay, Google Chrome and the Google Logo are trademarks of Google LLC.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Discover more about the Canstar awards at www.canstar.com.au